You are invited

I would like to welcome you to another Kyte educational event, this time on the subject of payments, more specifically security and compliance. After several events focusing on regulatory compliance we thought it was fitting to discuss the payment industry and its most relevant security standard, the PCI DSS. In these challenging times we have no option to keep this entirely online, but based on the feedback we receive don the last event in June, it seems that attendees don’t mind this at all… some have actually commented that this format fits in veryw ell with their daily duties. There has never been a better time to focus on your education!

Trevor Axiak

Director and Co-Founder at Kyte Global

About Kyte Global

Your Compliance is our main Priority

Kyte has been established in 2006 and has served the payments industry from its inception. Kyte was one of the first companies to become a QSA company internationally and has since certified hundreds of entities, from Acquirers to Issuers to PSPs and merchants against the PCI Standards. Over the years and in the last 5 years especially, Kyte has recognized that clients need to constantly comply to new requirements, new regulations and various standards, sometimes not by choice but merely to be able to do business. We have reacted to this need and aligned our strategy to assist our clients meet these challenges. We have built dedicated teams, with experienced professionals all experts in their respective fields, to provide the assistance needed in various compliance areas. This ranges from GDPR, AML, PSD2, ISO27001, EBA Guidelines, Financial Institution regulations, SWIFT and more. We have also partnered with some industry leading solution providers for delivering the tools needed to meet these compliance obligations. The needs of our clients have transformed us into a one-stop-shop for compliance!

- Remote Gaming Licensing

- Information Security

- Internal Audit

- AML/KYC

- Fraud Management

- GDPR

- PCI DSS

- Penetration Testing

- ASV Scanning

- IT Assurance Services

- SOC (Security Operations Centre)

- Vulnerability Management

- Kyte Crypto Services

- Back Office

- Payment & Banking

- Corporate Services

- Legal Services

- Financial Institution Licensing

14

Years of experience

60+

Countries

650+

Satisfied clients

1350+

Successful projects

About our event

Join us for some industry updates

Join us for an interesting event that will focus on issues related to payments, both from the consumer side as well as the service provider side. We will analyse security risk and challenges that IT administrators face on a daily basis as well as those challenges that affect compliance. We have some very interesting presentations from experts in the industry who will draw on their own personal experiences. This event is intended to strike a balance between technical concepts and compliance matters. If you work in payments or are responsible for compliance within payments, this event is perfect for you!

Audience & Topics

Our conference is designed for InfoSecurity and Compliance officers, consultants, and C-level viewers in general. We will share valuable information on latest trends, what’s making the headlines and leading security solutions to improve security within your organisation

Global Reach

More than 20 speakers from 9 different countries (USA, Belgium, Netherlands, UK, Denmark, Sweden, Malta, France, Germany) will meet on our virtual stage. We aim to prepare content that will be interesting for you regardless on where you are.

CPE Hours

After attending our online event you can request a certificate to be able to claim your CPE hours. Please get in touch with Ella at ella@kyte.global

Online Format

You will be able to select and connect to our conference with focused and tailored content, all from the comfort of your home or office. Conference is designed to be entirely online for our participants so you don’t need to worry about crowds. Social distancing does not apply!

Agenda

Securing Online Payments

Choose a convenient time for you to join the event, and we’ll send you a calendar invite with an exact time. Or just join our stream for the whole morning.

9.00AM-9.20AM

Virtual Coffee

Virtual Coffee

9.00AM-9.20AM

Virtual Coffee

Virtual Coffee

9.20AM-9.30AM

Opening Remarks

Opening Remarks

Trevor Axiak

Director and co-Founder at Kyte Global

9.20AM-9.30AM

Opening Remarks

Opening Remarks

9.30AM-9.50AM

Get Secure. Get Compliant. Get Back to Business

Get Secure. Get Compliant. Get Back to Business

Evan Hunter

Strategic Payments Professional, Tokenex

9.30AM-9.50AM

Get Secure. Get Compliant. Get Back to Business

Get Secure. Get Compliant. Get Back to Business

9.50AM-10.10AM

How Security Operation Centers services can support your PCI approach

How Security Operation Centers services can support your PCI approach

Christophe Bianco

Co-Founder and Managing Director, Excellium

9.50AM-10.10AM

How Security Operation Centers services can support your PCI approach

How Security Operation Centers services can support your PCI approach

10.10AM-10.30AM

Change Management as PCI DSS pillar

Change Management as PCI DSS pillar

Aslan A. Afshar

QSA, Kyte Global

10.10AM-10.30AM

Change Management as PCI DSS pillar

Change Management as PCI DSS pillar

10.30AM-10.50AM

Minimizing PCI costs while ensuring optimized conversion

Minimizing PCI costs while ensuring optimized conversion

Nir Levy

VP Product and Professional Services, Credorax

10.30AM-10.50AM

Minimizing PCI costs while ensuring optimized conversion

Minimizing PCI costs while ensuring optimized conversion

10.50AM-11.15AM

Safeguarding the online eCommerce experience for consumers and merchants alike

Safeguarding the online eCommerce experience for consumers and merchants alike

Daniel Buttigieg

Head of Business Development

10.50AM-11.15AM

Safeguarding the online eCommerce experience for consumers and merchants alike

Safeguarding the online eCommerce experience for consumers and merchants alike

11.15AM-11.30AM

Merchant Compliance. A QSA's perspective. - Valid8

Merchant Compliance. A QSA's perspective. - Valid8

Trevor Axiak

Director & co-Founder, Kyte Global

11.15AM-11.30AM

Merchant Compliance. A QSA's perspective. - Valid8

Merchant Compliance. A QSA's perspective. - Valid8

11.30AM-12.00PM

Trends in Payment Acceptance - Reducing Risk for Merchants and Consumer

Trends in Payment Acceptance - Reducing Risk for Merchants and Consumer

Ronan Gallagher

Chief Customer Officer

11.30AM-12.00PM

Trends in Payment Acceptance - Reducing Risk for Merchants and Consumer

Trends in Payment Acceptance - Reducing Risk for Merchants and Consumer

12.00PM-12.15PM

Break

Break

12.00PM-12.15PM

Break

Break

12.15PM-12.30PM

Information Security Mandated by GDPR

Information Security Mandated by GDPR

Alan Alden

Director & co-Founder at Kyte Global

12.15PM-12.30PM

Information Security Mandated by GDPR

Information Security Mandated by GDPR

12.30PM-1.00PM

Vulnerable Configurations: The Lowest-Hanging Fruit

Vulnerable Configurations: The Lowest-Hanging Fruit

Erim Bilgin

PenTester, Kyte Global

12.30PM-1.00PM

Vulnerable Configurations: The Lowest-Hanging Fruit

Vulnerable Configurations: The Lowest-Hanging Fruit

1.00AM-1.30PM

Compliant by choice - boosting company standards

Compliant by choice - boosting company standards

Dima Kats

CEO, Clear Junctions

1.00AM-1.30PM

Compliant by choice - boosting company standards

Compliant by choice - boosting company standards

1.30 PM-2.00PM

Achieving PCI Compliance in Containers and Kubernetes Environments

Achieving PCI Compliance in Containers and Kubernetes Environments

Francis Kyereh

QSA

1.30 PM-2.00PM

Achieving PCI Compliance in Containers and Kubernetes Environments

Achieving PCI Compliance in Containers and Kubernetes Environments

2.00 PM-2.30PM

Q/A – Open Discussion/Consultation

Q/A – Open Discussion/Consultation

2.00 PM-2.30PM

Q/A – Open Discussion/Consultation

Q/A – Open Discussion/Consultation

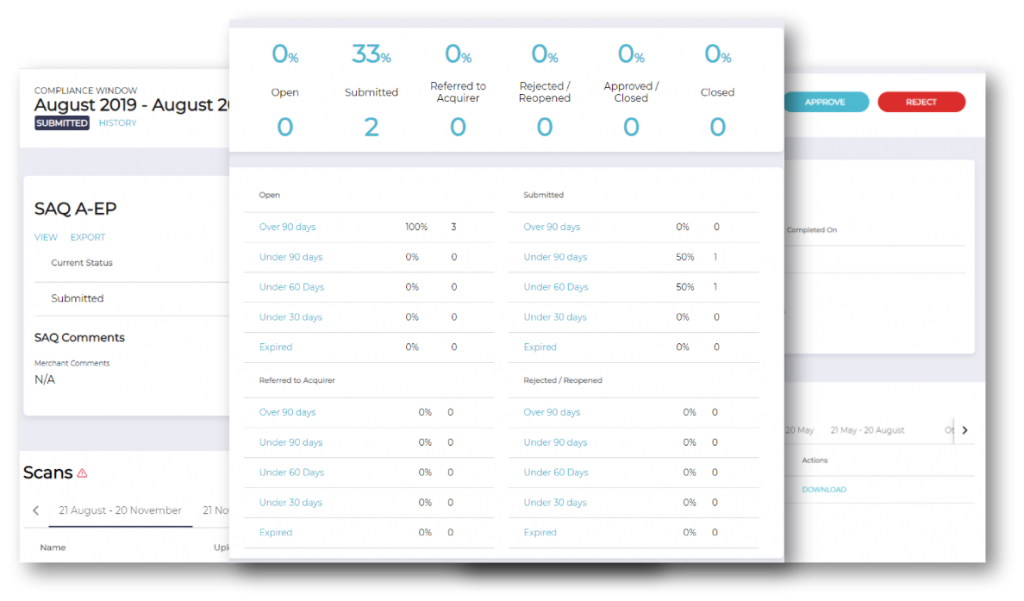

Launch of our compliance reporting platform - Valid8

Would you like to schedule a demo of

our new product right now?

In the payments sphere, Kyte has recognized the need for proper monitoring of compliance when it comes to banks enforcing compliance on its merchants. Kyte has developed its own Merchant Reporting Portal which allows small-medium merchants to self assess (based on predetermined set of questions and documents to be uploaded) and for the bank itself to monitor the compliance progress, send/receive notification of due/overdue compliance records, and report to Visa and Mastercard the compliance status of their merchants. This portal automates several tasks and provides dashboards that enables a bank to perform the mammoth task of monitoring thousands of merchants on an ongoing basis.

Features

Valid8 by Kyte Global

We are happy to launch our new product Merchant Reporting Portal during our online conference this December. If you would like to request a demo or learn more about it please don’t hesitate to get in touch with us via email ella@kyte.global.

Merchant Services

Training

Security Awareness Training

Incident Response Training

Secure Coding Training

ISO27001

GDPR

AML

ASV Scanning

Tools & Security Solutions

Security Scanning Tools

Penetration Testing

Fraud Management Tools

KYC & AML Solutions

GDPR Solutions

Managed SOC

Consultancy

Merchant Support

Level 1 – support – help centre

Level 2 – support - QSA

Multi-lingual

Flexible Hours of Operation